Solutions

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Platform

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

INCRMNTAL’s core technology is based on predictive algorithmic technology. Using thousands of signals, our platform allows people to measure incrementality without requiring them to run any planned experiments. We only mention this, as annual market predictions are supposably something we should be really great at – BUT – given the nature of our industry (marketing technology, advertising technology) – we don’t always get things right. Our industry tends to change frequently and drastically.

(if you like you can read our full 2024 predictions blog post)

The privacy manifest and similar regulations will significantly impact user-level attribution, making it increasingly difficult to track user journeys accurately.

We were right, with caveats.

Apple’s privacy manifest did not completely eliminate the option of user level attribution. Companies are still making use of user level data using IP to match clicks with conversions, in what is referred as Fingerprinting Attribution.

Google postponed the release of the Privacy Sandbox again, and its future remains a question mark.

Given that, IDFA opt-in rates remain low, hovering around 10%, and the accuracy of methodologies like Multi-Touch Attribution has dropped to below 50%.

Marketers will turn to alternative measurement methods like INCRMNTAL, GeoLift Experiments, and MMM to gain insights into campaign performance.

We were right about two, and wrong about one.

INCRMNTAL has continued growing, serving customers across Gaming, Fintech, Entertainment, eCommerce, Health, Travel, Mobility, Utilities.

We raised more capital, and over 700 companies discovered why INCRMNTAL’s methodology is considered innovative.

MMM has lost momentum. While we believe MMM technology is valuable for certain specific use cases, it was promoted as a tactical and operational measurement solution—which it isn’t. This mismatch led many companies to attempt adopting MMM, only to lose interest over time.

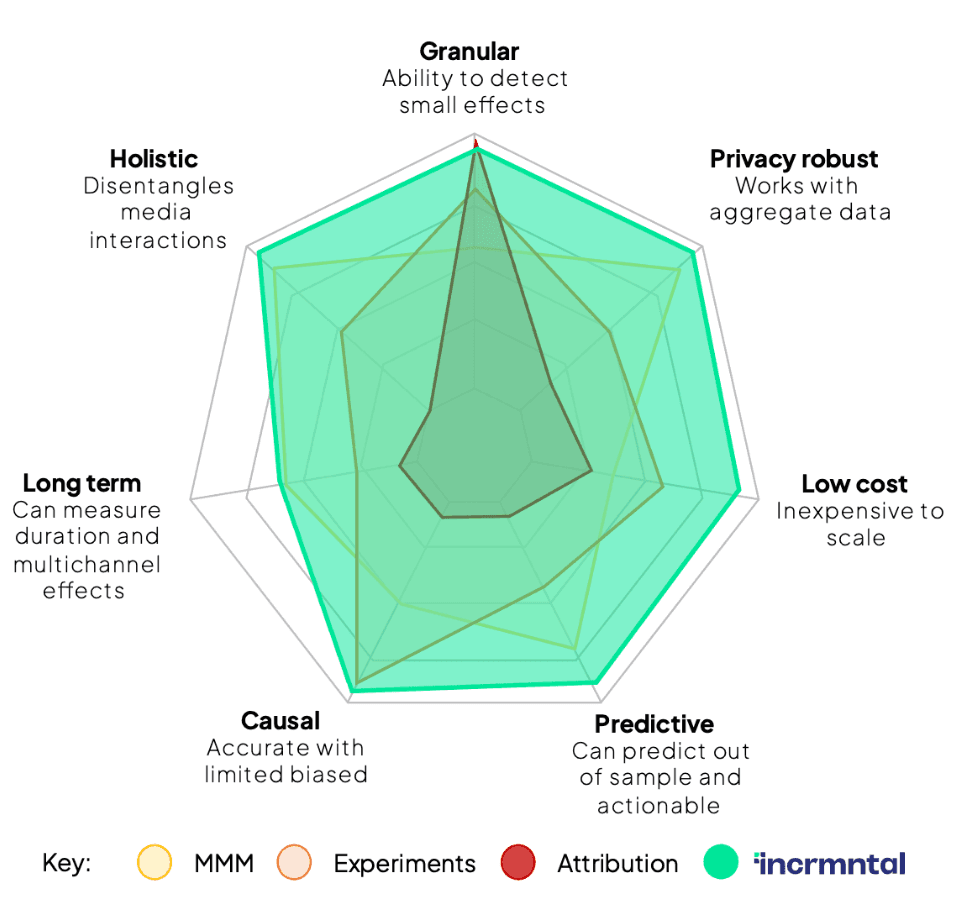

We wrote more about this in our post: The Perfect Measurement Solution.

More companies will consider in-housing programmatic trading to gain greater control over their ad spend and leverage first-party data.

We believe we were right, but we have no idea if we were right or wrong.

When advertisers take programmatic trading in-house , the outcome may be the same when it comes to ad spend. The beneficiary often is the advertisers’ efficiency gains as less middlemen are cutting their cut along the way.

Looking at the financials of The Trade Desk, a leading self-service DSP, we can see that its growth exceeded the industry growth substantially, and can consider this as evidence.

CTV/OTT advertising will continue to grow, but performance measurement challenges remain due to the lack of user-level data.

We were right. Full Stop.

During 2024, the number of CTV viewers surpassed linear TV viewers. That on its own is evidence enough, but beyond that – ad spend, and proportion of ad spend gradually continues increasing across the medium.

Mobile attribution platforms such as Appsflyer, Kochava, Adjust, and Singular, attempt to ride this trend by claiming the ability to measure – however, mostly this is done by attempting to triangulate the IP between the device showing the ad (i.e. a connected TV), and devices using the same IP downloading an app.

INCRMNTAL has a better solution for CTV measurement, which is why so many advertisers use our platform to measure the performance of CTV platforms such as Roku, VIBE. tvScientific, Tatari, Hulu, Netflix Ads, and others.

The concept of "Everything is a Network" will become more prevalent, but data privacy concerns will limit the extent of data sharing.

Right on this one as well!

Retail Media, or “everything is a network” as Eric Seufert phrases it, has not stopped, with UBER reporting over $1bn in revenues from advertising, and almost any major brand with a unique reach leveraged this opportunity. From Office Depot, to Zalando, to 7-Eleven, to Decathlon.

Privacy restrictions limit companies from being able to share 1st party data creating a large network – however – Retail Media has been so beneficial to those who deployed it, that there’s no real reason to allow any 3rd party middlemen to take a cut.

Discrepancies between advertiser and platform reporting may arise due to differing data access and measurement methodologies.

We were right, but early.

While writing this blog, AppLovin’s market cap has gone to almost $100bn. AppLovin’s success can be directly attributed to their usage of algorithmic attribution. Meta, who initially lost significant market value due to ATT, has not only gained it back, but exceeded all revenue and performance expectations over the past two years.

Algorithmic Attribution is allowing ad platforms to generate performance without relying on 3rd party attribution to provide the indication of conversion happening (i.e. a Postback). This means that overtime, the role of MMPs as a measurement solution will diminish, and MMPs core offering will revolve around services, and data infrastructure.

This whole process is happening in-front of our eyes, but as predicted – it will take at least 3-4 additional years to be completed.

Our hope is that INCRMNTAL may take the position as the unbiased measurement platform, allowing both parties (demand & supply) to operate at maximum efficiencies.

The rise of subscription models may impact advertising budgets and reach as users opt out of ad-supported services.

We got this one wrong.

Netflix which launched an ad supported tier after resisting it for years – is now attributing much of their growth to this model. Offering consumers with choice (Subscription, or Ad Supported) allowed Netflix to enjoy growth on both sides.

Users wishing to opt out of ads are paying full price, while users choosing the ads supported tier are driving significant net profits to Netflix and anyone who follows this practice.

Consumer subscription fatigue (having so many different subscription services) has probably been the main driver against this original prediction.

AI will play a significant role in digital marketing, from campaign creation to measurement and optimization.

This one was too easy. Obviously: Right

This prediction was almost as if we would have predicted that “Next year will have 12 months”. AI is everywhere, and during 2024, we were introduced with a lot more tools and services leveraging generative AI.

INCRMNTAL’s technology is built using causal AI, our flagship product INCRMNTAL Explorer uses causal discovery, reinforcement, and our Insights feature uses GenerativeAI to come up with clear recommendations.

Tools like Poolday.ai generate thousands of videos for creative A/B testing, and Lightricks LTX Studio allows marketers to come up with full length videos with high production values. ChatGPT, Claude, Gemini, Preplexity AI, and others are just a glimpse of the capabilities AI brought for us. It’s incredible to live in this era, which reminds me of what it was like as a kid seeing computers go from large dusty useless machines, to supercomputers in no time.

Overall, we got most of it right. Even if some of these were pretty basic or obvious.

As 2024 is coming to an end, we start thinking of the next years to come, considering what will change again in our fast moving, frequently changing world.

Our 2025 predictions will be published next month . We are hoping to get it 95% correct. That’s a pretty good confidence level, just ask any data scientist. ☺

Maor is the CEO & Co-Founder at INCRMNTAL. With over 20 years of experience in the adtech and marketing technology space, Maor is well known as a thought leader in the areas of marketing measurement. Previously acting as Managing Director International at inneractive (acquired by Fyber), and as CEO at Applift (acquired by MGI/Verve Group)