Solutions

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Platform

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

The following article is the second in a two-part series written by Maor Sadra, INCRMNTAL’s CEO. If you have not yet read part one – read it first here

Following the deprecation of device identifiers, many believe that the only way to sustain the value chain is by continuing the attribution process with less reliable data by using “fingerprinting”.

Fingerprinting attribution uses the same exact mechanism of the device identifier postback, with the difference of it being a) less precise and b) forbidden by the mobile platforms (i.e. Apple).

Major ad platforms such as Google, Meta, AppLovin, and others – understand that going against Apple’s policy is not going to fly, and they’ve had to find a new way to provide value for Advertisers. A way that doesn’t rely on the attribution postback.

This realization started a new wave of algorithmic probabilistic attribution moves:

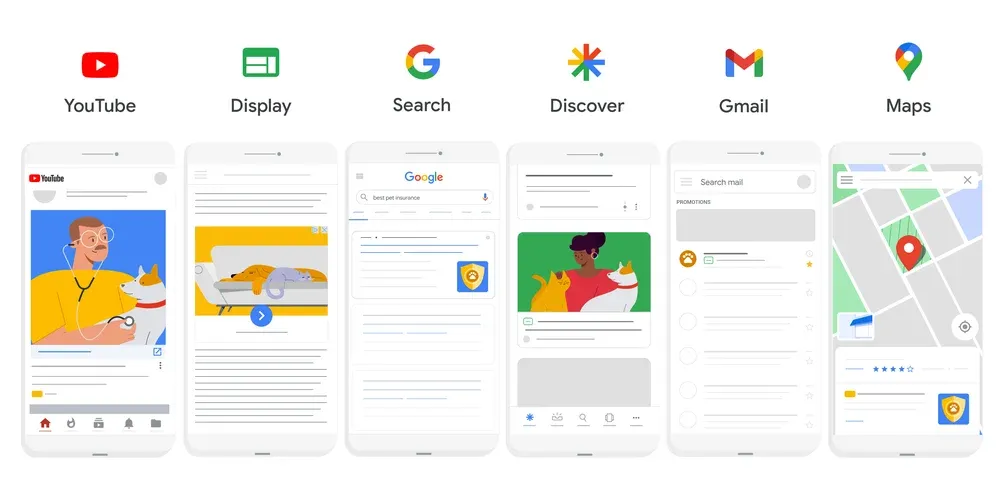

While Google was not highly affected by the deprecation of the IDFA, Google was the first to market with a product called PMAX (“Performance Max”)

Performance Max helps you drive performance based on your specified conversion goals, delivering more conversions and value by optimizing performance in real-time and across channels using Smart Bidding. Performance Max uses Google AI across bidding, budget optimization, audiences, creatives, attribution, and more.

(Taken from Google Ads Documentation)

(Image credit: Google Performance Max)

When Apple killed access to the IDFA – no company was affected more than Meta. Some estimated that Meta lost approximately $5bn in revenues during the following years. However, Meta had a massive “comeback” of revenues and performance with its release of AEM campaign type:

Aggregated Event Measurement (AEM) is designed to help keep data used to facilitate conversion reporting and ads optimization private. It will continue to evolve to help our advertisers support consumer privacy.

(Taken from Meta Ads Documentation)

Meta’s new campaign type is driving phenomenal performance to Advertisers. Interestingly enough, 3rd party attribution doesn’t give Meta much credit, since Meta doesn’t collect IDFAs anymore – yet – Meta seems to be back on top, being reported (again) as the best channel for most mobile app marketers.

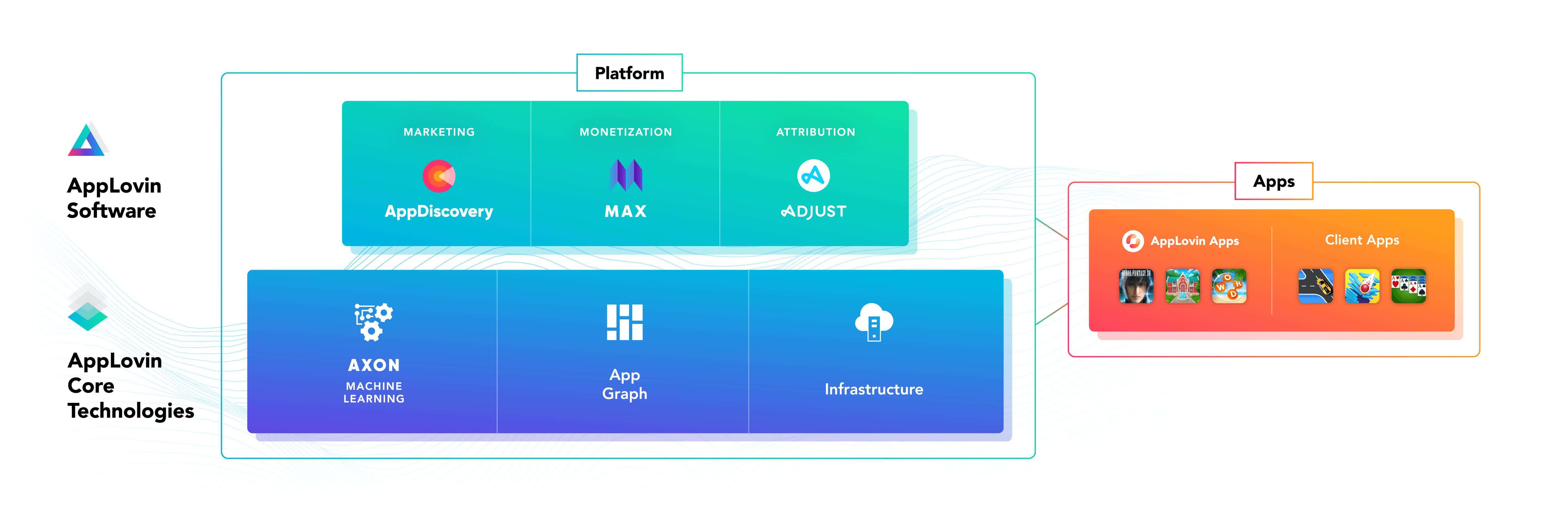

While not as large as Google and Meta, AppLovin has always been one of the smartest platforms in terms of making the right moves, and when 3rd party attribution started to lose its credibility, AppLovin took advantage of the opportunity to release Axon 2.0 in Summer 2023. This new cool named algorithm was a game changer for AppLovin.

Axon 2.0 is an updated version of AppLovin's AI-powered ad tech software. It was released last year (2023) and relies on predictive machine learning to target app-install ads to the users most likely to download those apps.

(from AppLovin’s documentation)

(Image credit: AppLovin Annual Report)

(Image credit: AppLovin Annual Report)

Applovin is becoming a top ad platform for many iOS developers/advertisers.

And Applovin’s entrance into algorithmic attribution is the strongest signal that other large ad tech players will jump on this trend, such as IronSource/Unity, Digital Tourbine, Vungle/Liftoff, and others.

The postback mechanism had a major flaw. It only gave one ad platform ALL credit, conditioning ALL ad platforms to compete in a race to the bottom. Rather than finding the “audience most likely to convert” with messaging, targeting, and context - ad platforms were almost forced to go for the users that are most likely to convert immediately after the ad engagement.

Unwillingly free from Postbacks – ad platforms had to completely rethink how they would continue getting credit in a privacy-first world, where most conversions end up getting attributed as “organics”.

Beyond credit, ad platforms had to re-think how they would generate VALUE for advertisers. By utilizing 1st party data, AI, and advanced algorithms, ad platforms were able to focus their efforts on creating actual probabilistic attribution capabilities. PMAX, Axon, AEM, are only the first named examples for these first movers.

A Special Ode to Meta:

Meta, in my opinion, deserves recognition as the poster child for algorithmic attribution, and the death of the postback.

Following the deprecation of the IDFA – Meta lost signal it relied on for optimization, received less credit, and as a result, budgets. But following the launch of AEM – Meta’s algorithmic (probabilistic) method of attribution – Meta’s performance to advertisers massively improved, leading more and more Advertisers to allocate their advertising dollars back to Meta. All this, while attribution reports continue giving poor credit to Meta.

The benefit in this new algorithmic attribution by ad platforms is clear – ad platforms are focusing their best efforts into yielding amazing incremental performance for advertisers, leveraging their knowledge over their own inventory and audience, rather than continuing to fight for credit.

Rather than the continued race to the bottom – Ad platforms can now really focus on bringing value.

The only challenge in this new reality will be the fact that there’s no “referee”. Yet.

The biggest benefit of 3rd party attribution was the fact that the referee distributed the conversions among ad players. While it wasn’t always fair, and based on this article – was often the cause for issues – acting as a referee allowed the Advertiser to have sensible reporting, and build an operational layer on top of their reporting data.

In this new reality, where all ad platforms will eventually do their own algorithmic attribution, the reporting data will cease to make sense. An Advertiser summing up the reports of their top 3 channels, will see more conversions than they actually have in their own servers.

Choosing how to allocate ad spend among platforms, will continue being a difficult task.

Yes, thank you! we would love to.

But it’s not just up to us. The industry moves as a hive mind, and over time, a new standard will be set based on the forces of the industry.

INCRMNTAL is in a great position to take this lead, as our platform delivers incrementality reporting, and is not biased in any direction.

Simply put: We don’t stand to gain anything by putting an ad platform in a positive light, and another in a negative light.

Each advertiser may use the platform to understand the VALUE of their marketing channels, campaigns, and even ad groups, without falling into the trap of attributing a single ad engagement (i.e. click) to a single ad platform.

Becoming that standard is our own ambition of course. It aligns with the vision we set out to achieve when we started INCRMNTAL in 2020: evolving marketing from counting clicks to measuring VALUE. You can read more about what the future of measurement looks like with INCRMNTAL here.

Maor is the CEO & Co-Founder at INCRMNTAL. With over 20 years of experience in the adtech and marketing technology space, Maor is well known as a thought leader in the areas of marketing measurement. Previously acting as Managing Director International at inneractive (acquired by Fyber), and as CEO at Applift (acquired by MGI/Verve Group)