Platform

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Solutions

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

If you’re an old timer like me, you’ll remember that somewhere in 2012, people in the adtech community used to say: “Next year is the year of mobile”. For those who already moved to the mobile space, it was obvious that the year of mobile already happened, and that mobile was growing exponentially fast. When I personally made the switch from Desktop to Mobile, I was surprised about how big the mobile space was

CTV is now getting a massive hype. Everyone’s saying that “CTV is the next inventory frontier for performance marketers” – but CTV has been growing rapidly over the past several years already.

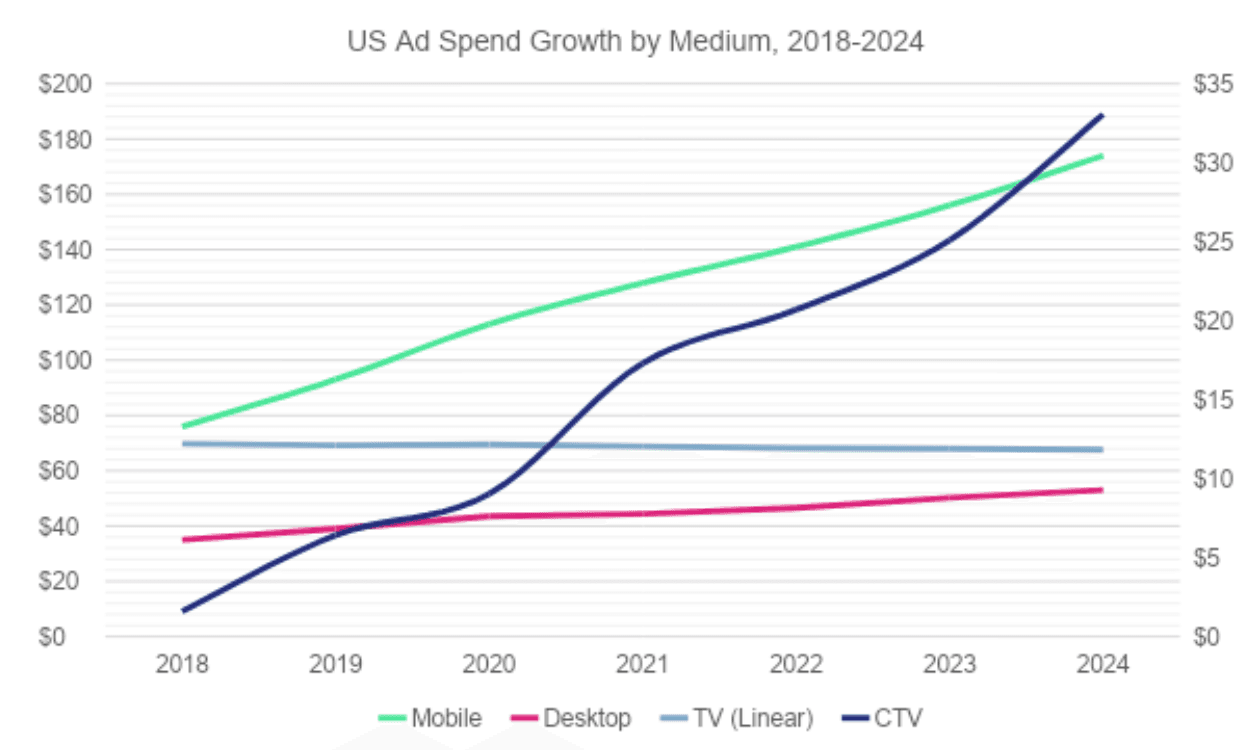

To give some perspective to the graph below – between 2018 and 2022, Mobile Ad Spend grew by 186% , while CTV ad spend grew by 1,300%!

(Source: eMarketer US Ad Spend Forecast)

CTV has been gaining popularity over the past several years with the migration of audience and content from live TV (linear) to video on demand (VOD). Media content owners and publishers like Roku, Hulu, HBO, Paramount, Showtime, Apple TV+, Netflix, Disney+ and others have all grown their user base over the past several years.

But with the rise of paid subscription services, platforms started seeing a slow down in new subscribers and as a result – revenues.

Learn More: Best TV Ads Tracking Software

CTV Advertising has been on the rise, as ad inventories started opening up. To combat the new competitive landscape, and the churn of subscribed users, many of the services, including those who stated that they will never show ads – started offering an ad supported tier.

During the past 12 months, almost all streaming services have an ad supported tier.

Alongside the opening up of these inventories, the digital adtech world changed dramatically. Changes and regulations related to privacy caused advertisers to lose the capability of user-level tracking. And with that gone, the prices of digital advertising across performance channels went haywire. With limited or often no ability to target audiences, advertisers relied on contextual advertising, optimizing placement, and creatives.

TV advertising has always been a high impact medium. It was considered as a premium channel, as it offered full screen video ads, capturing users attention. But advertising on linear TV required substantial investment and resources. TV advertising was rather local, and would often need to go through various local compliance checks, and even bureaucracy. If a US advertiser wanted to launch a TV campaign in Germany (for example) they would most likely need to work with a local agency which understands the laws, regulation, and have the relevant connections with television channel advertising teams.

Learn More: How Can I Measure Performance For TV Campaigns?

Advertising on CTV on the other hand is often done using online advertising platforms, some of which offer self service tools, allowing an advertiser to launch a TV campaign in minutes.

Streaming services and CTV offer the most incredible and high impact placements available today. Beyond this, CTV advertising is still considered “new” meaning less competition, allowing advertisers to capture this space to enjoy even better performance as a result.

Measuring the performance of CTV campaigns has been challenging for advertisers. With over a decade where advertisers relied on user-level tracking for measurement, it seems that many advertisers continue trying to apply the same flawed method for CTV advertising measurement.

We often run into advertisers that started and paused their CTV campaigns, as their measurement approach led them to see extremely poor results reported.

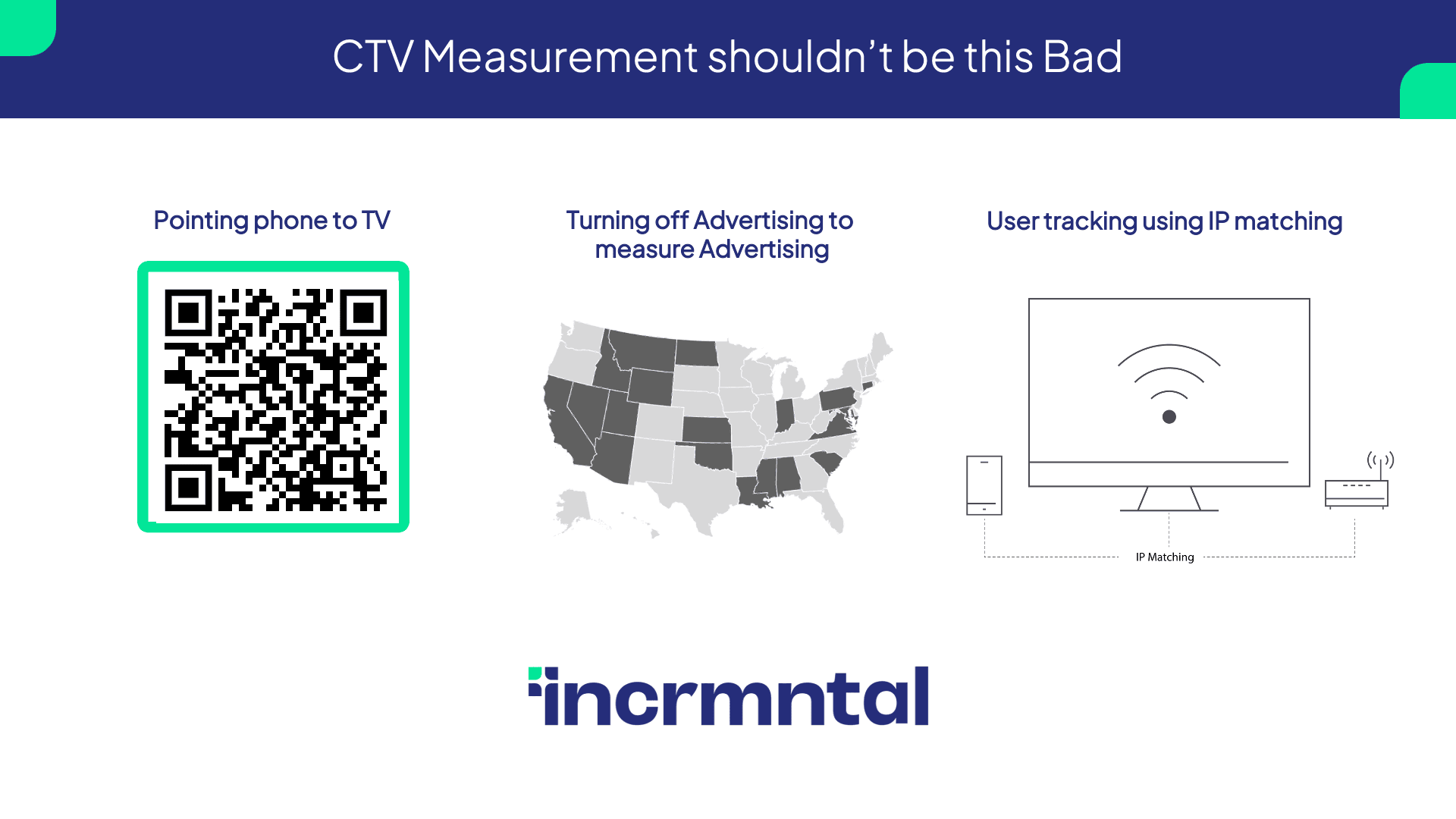

The three most flawed measurement methodologies for CTV advertising are:

The principle of this methodology is similar to a tracking link on the internet. A user will see an ad for a product or service they like, and will scan a QR code using their smartphone to get to the advertiser’s website or app. Sounds simple.

In my view, this is probably by far the worst use-case for measurement of CTV ads. Let's start with the obvious: Many of us use our smartphones to watch streaming services. We can’t, simultaneously, use our phone camera to point at a QR code on the screen.

But moreover – consider the user experience: a user watching a video, will continue to watch the video following the ad break, and will not now abandon their movie/tv show to go and download an app or a product.

What ends up happening when advertisers utilize QR for CTV campaign measurement is that only a fraction of users will use the QR code and convert, which in turn, would report low number of attributed conversions coming from the campaign.

Many advertisers that used this approach to measurement, ended up shutting down the majority of their CTV ad buys, thinking that CTV had low performance.

One of the oldest methods of incrementality measurement relied on this approach. Turning advertising on in some sections, and off in others, comparing the performance lift in the regions where advertising was turned on to the “baseline” performance in the regions where it was off.

While the methodology itself is sound, it relies on the advertiser creating a sterile environment, to not “taint” the ability to measure the impact of the CTV campaign over the tested regions.

Marketing is far from being a sterile environment. Marketing performance can be affected by dozens of variables – anything from weather, to competition, to promotion and so on.

But beyond these – the average marketing department makes dozens and sometimes even hundreds of tiny changes in marketing campaigns: creative changes, bid optimizations, targeting optimizations, launching/pausing/restarting/scaling ad groups, campaigns and so on.

The marketing orchestra is almost always playing in an organized chaos.

The notion of a sterile environment to test the effectiveness of marketing is almost wishful thinking for an advertiser that operates at scale. We wrote a whitepaper about ground truth experiments that you can download for free here.

Utilizing IP tracking to match between user clicks and conversions is known as fingerprinting. It is an extremely unreliable methodology of measurement, mainly as all users on the same network share the same IP address. Fingerprinting has been used more and more in mobile marketing attribution in the past years, as privacy regulations kicked in, and most of the attribution companies want to continue showing reporting to advertisers. There are no statistics over the match rate of fingerprinting attribution, but industry experts estimate that this figure is lower than 70%.

Trying to apply a user tracking approach to CTV measurement will lower the match rate substantially. For example, if the user is using mobile internet, while the CTV device is on the wifi network – the two devices will not have the same IP. And in that case, even if the user would see an ad on TV and immediately go and purchase the product or service advertised – IP tracking will not attribute the sale to the CTV campaign.

Fingerprinting as a method of CTV advertising measurement also goes against most privacy regulations. And while the CTV market is not (yet?) dominated by the same platforms dominating the mobile space , in order to track a CTV advertising, an attribution solution would need to collect user IP, and other device related data that are currently not permitted by the platforms.

CTV viewers are not trackable by advertisers, but that does not mean that CTV advertising is not measurable.

Moving away from the notion that tracking users is the only method measurement is an important step for many marketers, especially ones who were “born” into the digital era.

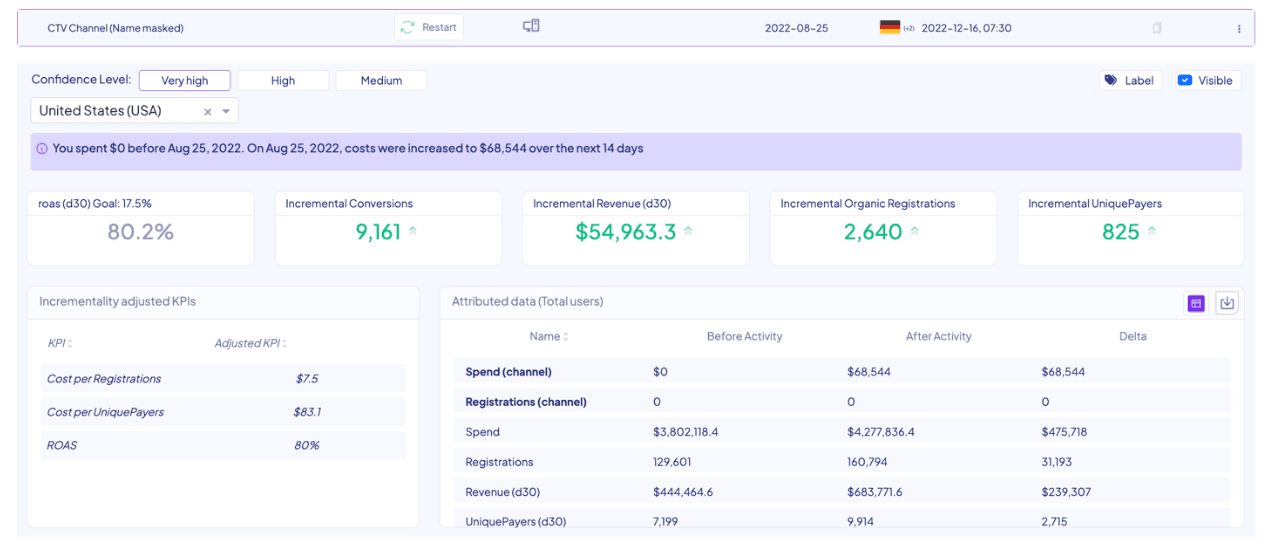

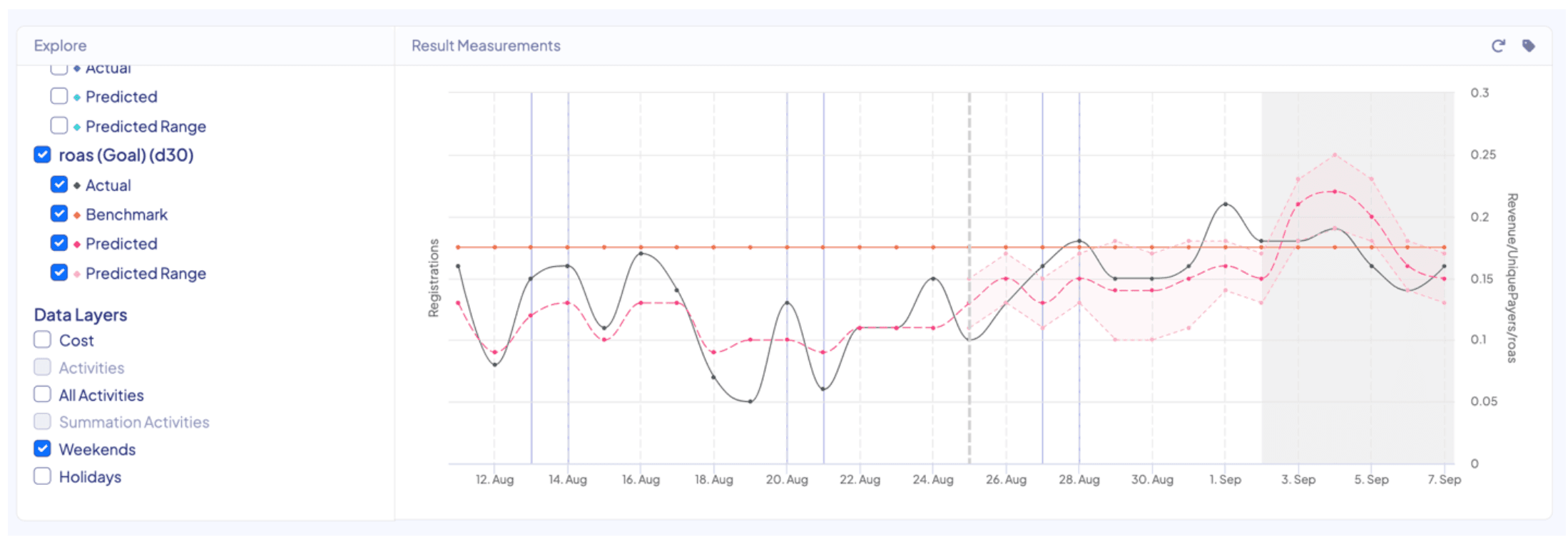

(Source: INCRMNTAL, CTV campaign measurement – Impact over aggregated ROAS)

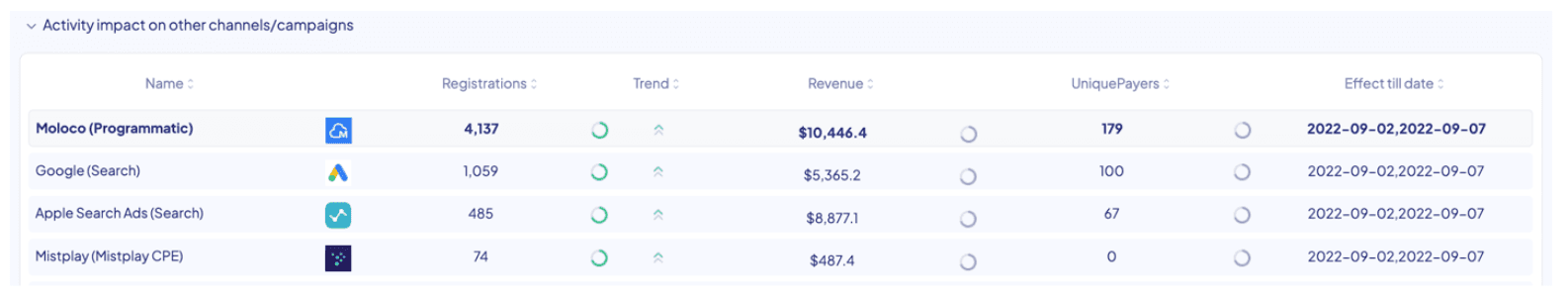

Brand marketers working at a company that prioritizes performance marketing will often feel frustrated, when they need to continuously prove the value of CTV activities by trying to measure the “organic impact” however, when applying a causality measurement for CTV advertising, what we can normally see is that starting a successful TV or CTV campaign will cause both organics and paid channels a performance lift.

(Source: INCRMNTAL, CTV campaign measurement – Impact over other channels)

The correct way to measure CTV marketing is by utilizing an always on incrementality approach that creates a causality connection between “campaign started > performance improved”, observing and looking at all paid marketing activities and paid marketing results.

It is an incredibly difficult task, especially for marketers at scale operating multiple channels, and making various optimizations on a day to day.

CTV advertising doesn’t live in a silo. The impact of TV advertising may be observed across search, programmatic, social, and any other channel an Advertiser is active with. Looking at organic lift only, will often cause advertisers to again under report the effectiveness of their CTV campaign performance.

INCRMNTAL is an always on incrementality measurement platform, allowing Advertisers to measure advertising activities across any CTV and any other medium. The platform has measured paid CTV campaigns across Netflix Ads, HBO, Roku, Paramount+, Disney+, Peacock, VIBE, tvScientific, The Trade Desk, PPM, as well as dozens of linear TV channels and OTT DSPs.

Book a demo to learn how you too can use incrementality measurement for all your marketing, including CTV.

Maor is the CEO & Co-Founder at INCRMNTAL. With over 20 years of experience in the adtech and marketing technology space, Maor is well known as a thought leader in the areas of marketing measurement. Previously acting as Managing Director International at inneractive (acquired by Fyber), and as CEO at Applift (acquired by MGI/Verve Group)