Platform

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Solutions

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

You don’t know that you’re going into a recession until you’re actually in one.

2022 symbolizes a year of drastic changes, and change is always challenging.

In relations to our own advertising industry – we’ve seen some drastic changes: Adtech stocks took a significant hit, companies who have not been able to raise additional capital due to investors being cautious after a year of investment at heightened valuations are conducting rounds of layoffs, even META, which accounts for 22% of the global advertising pie, had to lay-off 11,000 people due to macroeconomics downturn, increased competition, and ads signal loss.

Some analysts will say this is the result of the rapid growth of valuation of digital companies during the pandemic, some attribute the changes to Apple’s deployment of ATT. The reasons are for analysts to understand – the reality is here.

Marketing costs are often one of the largest cost items a company bears. Marketing a product typically (should) translate to more revenues, and as an investor once told me: “revenue fixes everything”.

But during a time of crisis, marketers might be tasked with a seemingly impossible task: Cut marketing spend while increasing efficiency.

To a marketer, scaling up ad spend, scaling up revenues, is the ultimate goal. Figuring out the right creative, strategy, messaging, channels, rates, setting up campaigns, and configuring audience targeting takes time and effort. Once at scale, the marketers’ role becomes more about optimization, testing new channels, testing new creatives and so on.

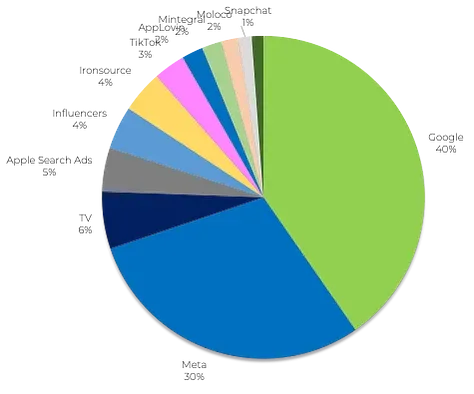

But cutting the right spend is brutal, as whilst a marketer runs at scale, the number of active channels representing a significant part of the ad spend is typically very low.

To a marketer, scaling up ad spend, scaling up revenues, is the ultimate goal. Figuring out the right creative, strategy, messaging, channels, rates, setting up campaigns, and configuring audience targeting takes time and effort. Once at scale, the marketers’ role becomes more about optimization, testing new channels, testing new creatives and so on.

But cutting the right spend is brutal, as whilst a marketer runs at scale, the number of active channels representing a significant part of the ad spend is typically very low.

Across all of our customers, slicing 90% of over $2b ad spend shows that a handful of channels represent the majority of ad spend.

Marketers must be vigilant in their efforts to reduce costs while minimizing the impact on performance, and follow certain steps.

The following steps were taken by several large scale advertisers using our platform., They all needed to reduce ad spend and improve efficiencies.

Before starting to work on ad spend reduction, make sure that you have an objective in mind. Here are a few examples:

An objective will make your job easier. The more concrete and quantitative, the better. With an objective in mind, you can run your tests and work against a concrete objective, rather than towards a vague goal.

Marketers make a lot of operational changes to their campaigns. Raising bids, lowering bids, swapping creatives, pausing campaigns, and so on. The changes you’ve made in the past could be a huge way for you to find out what you should be testing.

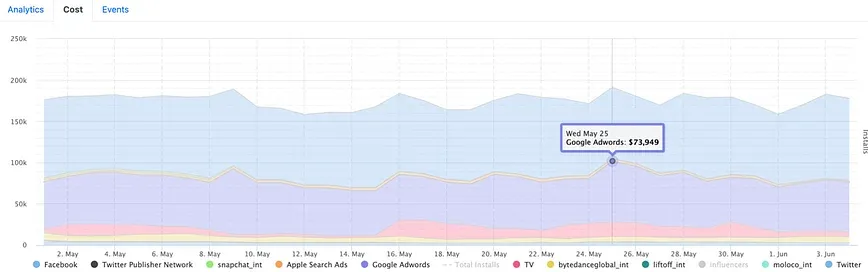

A simple way to find significant changes is to plot out ad spend by channel by county and/or platform in a stacked graph. Allowing you to spot the periods when you made or had drastic changes in ad spend.

Marketing Mix Modeling, or MMM in short, is a methodology where you throw an enormous amount of historical data, external variables data, competition data, and so on, into a modeling “blender” which creates hundreds, and sometimes thousands, of models to find the best marketing mix for a specific scenario. While MMM sounds great, it is not very operational. It requires significant data science resources, and time, to validate and make use of.

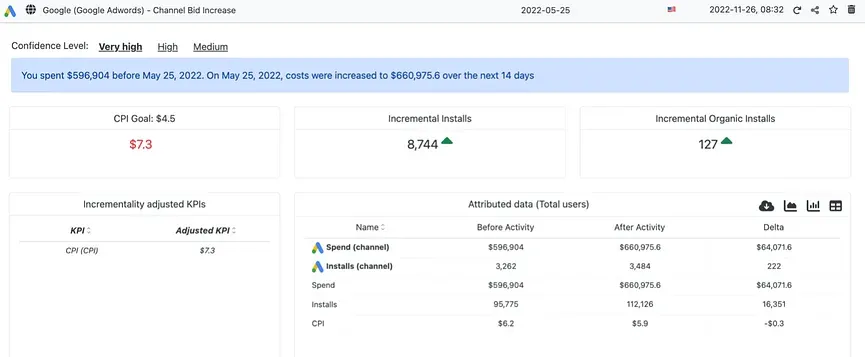

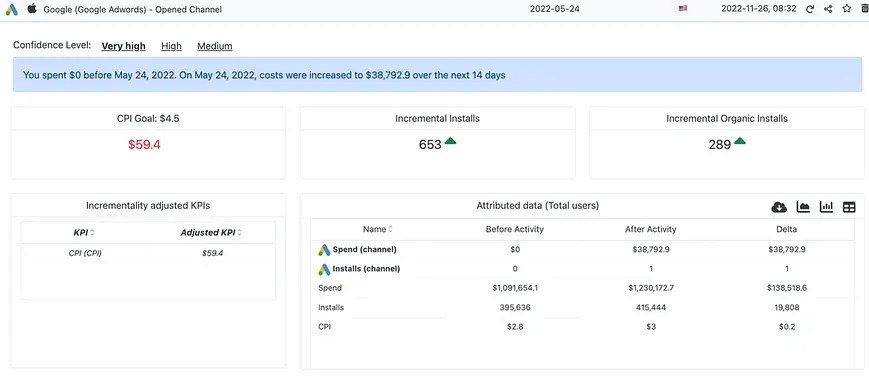

A simplified MMM output will look at the above spend increase in Google, comparing the Advertisers’ new sales revenues during the period before the increase and the period after, to come up with a directional insight for whether the spend increase yielded significant incremental sales or not.

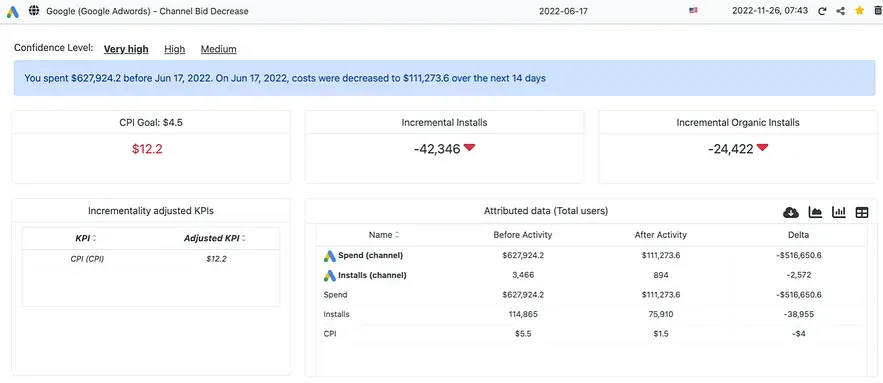

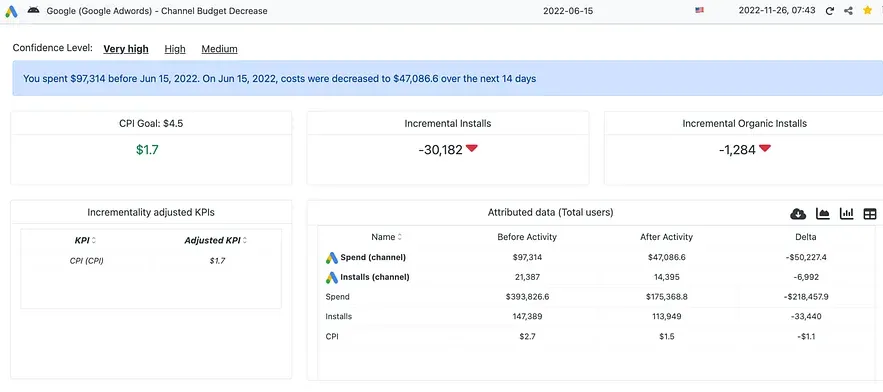

The below example shows actual incremental performance generated by spend increases on Google Ads Web, and iOS (the second example)

The more analysis you do over significant changes in the past, the better your action plan will be.

There is an old Winston Churchill Quote that says: “Never Waste a Good Crisis”.

When you make plans to cut ad spend, once you have a solid idea of which channels you should cut spend from – do it! Don’t be shy about it. Use a machete to cut spends by lowering bids by 50% , or capping your ad spend at a significant level of what it used to be.

If you are not using INCRMNTAL, you will need to isolate each change, and try to avoid making any additional changes that could interfere with your ability to understand the results.

Cutting ad spend will often help you understand the point of diminishing returns. You may find significant ad spend that has been cut but leads to no negative impact over sales. Such results will act as proof that the spend level you were running at was not returning incremental value.

But some cost reduction will show an immediate and significant impact over your sales. Those are the ones that you may want to scale back up, and give those a larger proportion in your new budget distribution. With such results, you will be able to reach your objective of reducing spending, while increasing efficiency.

Eric Seufert wrote a series of articles about what marketers should look at, do, and more importantly, not do, during a financial recession. You can find the series of articles here

Over the past several months, we have worked with countless companies who needed to move from a growth phase to an efficiency phase. Our product is objective and unbiased, as besides providing the best measurement results, it has no other incentive.

The platform was designed to be a value measurement platform, rather than relying on clicks, putting us in a position where both marketers that are trying to increase their budgets or cut them can leverage the platform just as much.

Maor is the CEO & Co-Founder at INCRMNTAL. With over 20 years of experience in the adtech and marketing technology space, Maor is well known as a thought leader in the areas of marketing measurement. Previously acting as Managing Director International at inneractive (acquired by Fyber), and as CEO at Applift (acquired by MGI/Verve Group)