Platform

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Solutions

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

By: Maor Sadra, CEO @ INCRMNTAL

The longest cliff-hanger in history was finally been resolved when Apple launched iOS14.5 (softly) followed by the hard push of

iOS14.6 to all iOS users at the end of May this year.

Over 80% of iOS users had a latest version of iOS by end of June. The version that enforces “app tracking transparency”.

1. App Tracking Transparency (or in short: ATT) is a feature introduced with iOS14.5 giving users more control of how apps can track their behavior

2. The new feature forces any app developer that would like to access the user’s device identifier to pop a system alert that explicitly asks the user: “Allow APP to track your activity across other companies’ apps and website?”

I have been following anything related to ATT very closely. The new privacy era is very close to INCRMNTAL’s heart. We had just started the company when Apple initially announced App Tracking Transparency in Summer of 2020. While INCRMNTAL never relied on user-level data, the change announced by Apple sent many developers inquiring about our solution for measurement.

During the past several months before and after the release, we started noticing several trends.

I wanted to use this post to summarize these trends and the actual impact we have seen as a result of ATT.

From Consolidation to expansion

The mobile advertising community experienced several large trends over the past decade: CPI networks, rewarded video, influencer marketing…but one trend overshadowed all and this was the infestation of attribution fraud.

Developers understood that attribution solutions could be easily defrauded by publishers sending millions of clicks and winning conversions (click spamming), or by triggering a click a second before the user opened the app (click injection), or even by launching a “farm” of devices that click ads and install apps in developing countries (click farms).

The problem was so severe that the attribution solutions themselves estimated fraud to represent anywhere between 10% - 65% of paid media!

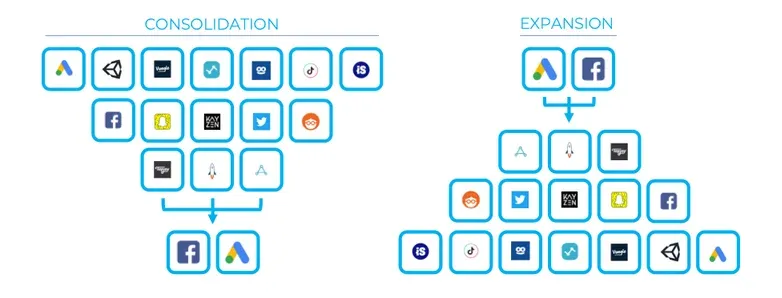

While some developers chose to use “anti-fraud-tools” (sometimes offered by the very attribution companies whose platform was defrauded), the common trend was to advertise with fewer ad platforms as possible. Specifically, consolidating spend with the two largest ad platforms: Facebook and Google

Facebook and Google had the largest user-graph data, allowing their algorithm to provide good results for any advertiser in almost any scale. Their optimization algorithms could find the right audience for any general and niche products in such high efficiency that it was a no-brainer for any advertiser to divert all of their budgets to the two.

Attribution solutions could not point out fraud towards Facebook and Google, as amongst several reasons – these platforms were self-reporting and not dependent on 3rd party attribution solutions.

ATT leveled up the playing field. Without access to user-level device identifier, Facebook, Google, and the other large ad platforms who used to self-attribute, can no longer do so.

But more importantly, the platforms could no longer offer the incredible user-graph based automatic optimization they could offer, making their inventory lose some of it’s effectiveness.

Eric Seufert wrote about this in Forbes, estimating that the impact of ATT on Facebook will sum up to $25B!

Ad Fraud drove advertisers to spend only with Facebook and Google. ATT caused the reversal of this trend. Advertisers are experimenting with new channels and new mediums.

Pushing the boundaries of the previous trend further, app developers have gone beyond screens into the real world.

“Offline” was a term used by app developer advertising occasionally on any medium that was not trackable using attribution URLs.

Some advertisers used offline as a show-off move. Placing a highly visible ad on the super bowl, but not doing any consistent TV ad buys.

Now that the large ad platforms efficiencies are shaken by the inability to use the device graph, app developers are starting to test various mediums more routinely:

Influencer marketing, physical flyers, billboards, measuring the impact of in-app promotions, and doing more systematic and consistent TV campaigns to help boost performance.

Advertisers are testing offline channels and going beyond the obvious. We’ve seen Advertisers testing physical flyers, billboards, measuring promotions, and TV.

Moving the conversion value around

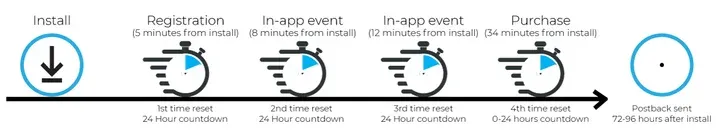

With ATT, Apple also announced upgrades to its proprietary attribution framework SKadNetwork. The upgrade included the support of conversion values allowing the reporting of app events from the advertised app.

Advertisers could use up to 64 conversion values to measure the journey and progression of a user within their app.

But Conversion value came with two major caveats:

Every time a conversion value is updated, a 24 hour delay timer is reset delaying postbacks to ad vendors

Apple has a discretionary privacy threshold setting that will only allow conversion values to be sent to ad networks if these could not be used to identify a user.

While the conversion value was a much needed addition to the attribution framework offered by Apple, the timer had developers worried.

No one wanted to risk getting their postbacks from Apple 30 days after the conversion, so developers put their thinking hats and invested in a day 1 conversion value that could represent a user lifetime value (LTV).

Developers used data science resources to develop a day one predicted LTV (pLTV) value based on the behavior of users within their app on the first day, so that postbacks from SKadnetwork could be used for optimization in ad spend.

However, what developers found was that using in-app behavior caused the conversion value to be further away from the moment of install, causing conversions to not pass the Apple Privacy Threshold.

Conversions that did not pass the threshold were attributed as “organic installs” by SKAdNetwork, making the developers ability to optimize paid media - impossible.

Most developers switched to using installs as their conversion value event. By doing so, more conversion values pass the privacy threshold, allowing advertisers to optimize spends by the effective cost per install.

It was like everyone forgot about the Privacy Threshold. When 90% of the conversions got attributed as organics – developers switched to using installs as the conversion value event.

Google, Facebook, Twitter, Amazon Ads, Snapchat, TikTok, Apple Search Ads, Pinterest – were all self reporting platforms. Using their size and proprietary 1st party data, enabled these giants to not rely on 3rd party attribution solutions to be responsible for attributing conversions they claimed they generated.

If Facebook showed the user an ad in the last 28 days and said user installed an app, Facebook would credit itself as having generated this install.

With the restricted access to the Identifier for Advertisers (IDFA), the platforms could no longer self-report, but would rely on SKadNetwork to determine the ad network who last touched the user as the one generating the install.

Almost overnight – the self reporting platforms lost a big chunk of their performance “edge” over ad networks who were not in a position to self attribute.

Ad platforms such as Unity, Applovin, IronSource, Vungle, Liftoff, Smadex, Kayzen and others benefited from the even playing field, as their performance appeared relatively better than it was in comparison with the self attributing platforms.

No big surprise here. The self reporting platforms “win” less conversions, while the non self reporting had an opportunity to compete over even grounds.

Desktop advertising seemed to have been forgotten by many advertisers over the past decade. Mobile advertising outgrew desktop as well as any other medium.

While developers for years had a beef with the app stores walled gardens and 30% fees – it was ATT that drove app developers to invest in a website and market a web product, allowing them to control both attribution and enjoy being masters of their own domain. Literally.

Any app developer that could develop a web user funnel is doing so. Developers realized that buying desktop inventory is valuable, and attribution is less of a hassle once you own your own domain.

Who knows, maybe next year is the year of desktop :-)

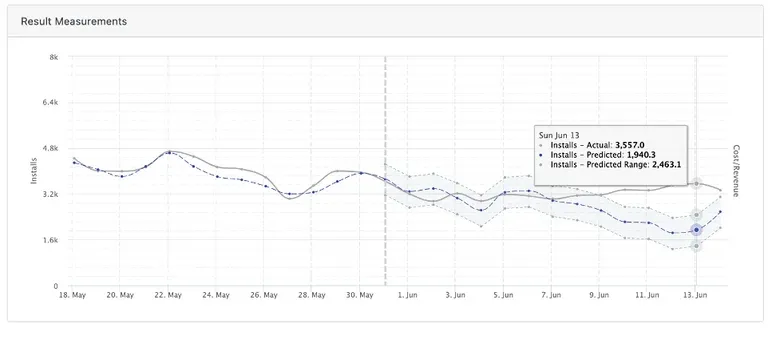

Our own incrementality measurement model can provide insights to customers about what is the impact of any external event.

We advised all of our customers to measure the impact of iOS14.5+ allowing them to see the exact impact of the influence over their marketing activities.

What we’ve seen across the board is the following:

The impact of ATT from an incrementality standpoint is volume neutral, positive profit. Developers who relied heavily on self-reporting platforms are seeing more conversions attributed organically, and with spend levels going down with almost no influence over revenues – the impact is translated into higher profits.

When Apple first announced the Privacy changes, I wrote a guest post with Adexchanger titled: “An Open Letter to Apple: Thank you for throwing the industry in flux”

And one year later, I still stand behind this post.

Thank you Apple. I think the changes you made were positive overall.

Maybe you could have been better in documentation and communication with the developer community, but overall, you did a good thing.

Yours,

Maor

(*app developers who monetized mainly with ads did experience an impact over revenues)

INCRMNTAL is a continuous incrementality measurement platform. Our software allows marketers to test out incrementality with a push of a button, and get results within seconds, with no need to run any experiments that require you to stop your campaigns.

If you want to learn more, visit INCRMNTAL or book a demo today!

Maor is the CEO & Co-Founder at INCRMNTAL. With over 20 years of experience in the adtech and marketing technology space, Maor is well known as a thought leader in the areas of marketing measurement. Previously acting as Managing Director International at inneractive (acquired by Fyber), and as CEO at Applift (acquired by MGI/Verve Group)