Platform

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Solutions

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

(And Claim That Promotion You Deserve)

You opened a store. Your store sells mobile apps.

You have an awesome location and great foot traffic, and new users are coming into your store every day and buying your apps.

You start an ad campaign, as you want to increase sales.

Your media vendor knows that you will keep the campaign up and running as long as they are able to bring new customers to your store.

Your media vendor goes around town seeking people who might be interested in your product, but that’s hard work.

A week in, your media vendor placed a booth outside your store, giving flyers with promo codes to people on their way to your store.

You are happy about the results the media vendor “generates” for you.

You sign a multi-million dollar contract with your media vendor.

Your store goes bankrupt.

Sounds like a ridiculous story. Right ?

The advertising world can be divided into two sides - the demand side and the supply side.

To keep things simple - Supply refers to media vendors, or those who trade/own in media inventories. Demand refers to those who buy media inventories to advertise.

There is an inherent conflict of interest amongst the two. As Inventory is limited by the number of ad placements, visitors and refresh rate - the supply interest towards growth is clear: INCREASE THE VALUE OF THE INVENTORY - i.e. optimize towards higher yields.

The demand side, Advertisers - have the opposite interest. They want to find inventories that can help create awareness, interest, desire and action by new (and existing) audiences, in order to increase sales. The customer acquisition cost must be lower than the customer lifetime value - otherwise, in the long term - the advertiser will lose money.

Media vendors invest a lot into customer relationship management for the sole purpose of making the customer feel that their interest is cared for. If you are a marketer - your objective may not align perfectly with your vendor’s objective..

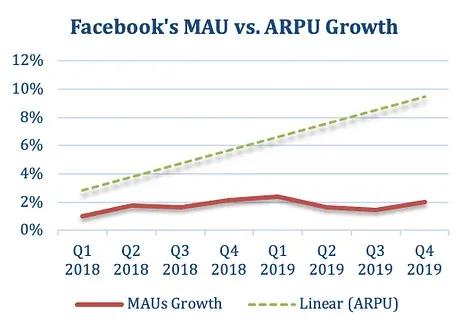

And you don’t need to buy my word – here’s Facebook’s financial reports showing the growth in monthly active users vs. the average revenue per user. 98.4% of Facebook’s revenues comes from Ads.

The pitch almost writes itself – you send the vendor a conversion post-back when a new customer is attributed to their campaign, allowing their platform to identify similar audiences, placements or other affinities, so that they can find more customers for you. Just like in the store analogy above.

What happens though – is that you are incentivizing your vendors to find the “easy to get” customers – those who may very likely already have the awareness, interest and desire to use your product.

The less inventories a media vendor uses to “generate” conversions for you – the higher the yield is – FOR THEM.

By now, everyone knows the infamous “Uber lawsuit” – Uber sued several ad vendors after finding that much of their performance marketing efforts were redundant. When Uber paused campaigns – paid media results went down, organic traffic went up in an almost 1:1 ratio.

The Media vendors were getting paid based on conversions.

The attribution solution was attribution conversions based on last-touch.

Uber DID get what they paid for.

But there was no value in 80% of the budgets spent.

Some of the vendors, conducted fraud – no doubt about this – they provided forged reports to Uber and breached the contract, but based on the information as provided in the lawsuit – when it came to paying for conversions that Uber would have received organically – but the reality when it comes to the fact that 80% of the inventory was over attributed was not a flaw. It was by design. The system did what the system was designed to do.

Attribution in mobile happens based on the vendor that touched the user last. It’s not an ideal method for attribution, but the biggest benefit it brings is that it can send out a feedback (post-back) when the event happens. When marketing at large scale – these real time events help marketers and vendors optimize the campaigns in almost real time, saving both budget waste as well as inventory waste.

i.e. if the Red banner has a 5% conversion rate , while the Blue banner has 1% - you don’t need a PhD in computer science to know that it is beneficial for everyone to focus the spend and media on the Red banner.

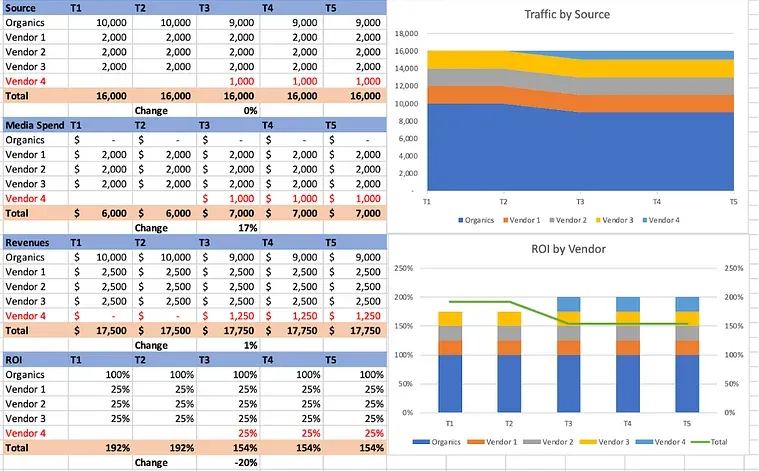

In the “EXTREME” example presented here, campaigns started with Vendor 4 on Week 3. ROI seems great. But When seeing the bigger picture – Vendor 4 adds no value to the Advertiser – they are winning attributions away from Organic conversions – taking credit for users that would likely convert without the additional spend.

This report does not indicate “fraud” necessarily. Vendor 4 may just have a great overlap with your user base. But fact is – Vendor 4 is winning credit and may win your budget, just because of how the system is designed.

INCRMNTAL uses your existing marketing data, focusing specifically on the changes, to find and provide you with actionable insights about the VALUE of your marketing spend and how you can unlock it.

With absolutely no bias towards any vendor – our technology does one thing – recommends big or small changes so that you can get even more value.

Our business model as a company reflects our belief – there is no charge for volume tracked, media spent, or budget “saved”. Pay as you go, software pricing. As a true trusted software provider.

Our platform doesn’t challenge how attribution is done. Attribution as it is, is a good product. It works.

But it is way too often providing wrong insights.

If you’re interested to learn more, schedule a demo today!

Maor is the CEO & Co-Founder at INCRMNTAL. With over 20 years of experience in the adtech and marketing technology space, Maor is well known as a thought leader in the areas of marketing measurement. Previously acting as Managing Director International at inneractive (acquired by Fyber), and as CEO at Applift (acquired by MGI/Verve Group)