Solutions

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Platform

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Mobile gaming companies are some of THE MOST sophisticated advertisers out there. These companies often employ data scientists, marketing analytics, and other stats junkies to develop methods to scale ad spend while keeping a close eye over diminishing returns.

When Gaming companies scale ad spend with a certain platform or channel, it typically means one thing: These channels work for them.

We have the privilege of being in a spot where Mobile Gaming and Gaming in general represents the lions share of our customer base, which is why we see a lot of ad spend across a lot of advertising channels.

We wanted to utilize this data in aggregation, and provide an analysis of which are the biggest Movers & Shakers in terms of advertising platforms between 2022 and 2023.

Performance is a relative term. An ad platform, any ad platform, may perform well for one gaming company, and terrible for another. Amazing during January, and horribly during March.

A marketer may increase bid from $1 CPM to $10 CPM making ROAS drop by 90%.

This is why we will NEVER create a performance “INDEX”. We are happy to provide benchmarks, and analysis over movers and shakers , but please do not take this as grounds to declare that “these are the best advertising channels for gaming”. This is not the intent, and not a responsible way of looking at advertising.

INCRMNTAL works with gaming companies across all shapes and sizes. Mobile games, Web Games, and Console games, across all sub genres of gaming: Casual, MMORPG, PvP, Hyper Casual, Skills, Real Money, Match 3, Social Gambling, and IP Games.

Our platform measures ad spend across every medium: Digital (Meta Ads, Google, TikTok, Moloco, Smadex), TV (linear TV, ConnectedTV, OTT), Influencers (MrBeast, StreamElements), and so on.

Aggregating all ad spend by channel for 2022 vs. 2023 (adjusted to full year), allowed us to compare absolute and relative trends of ad spend by channel.

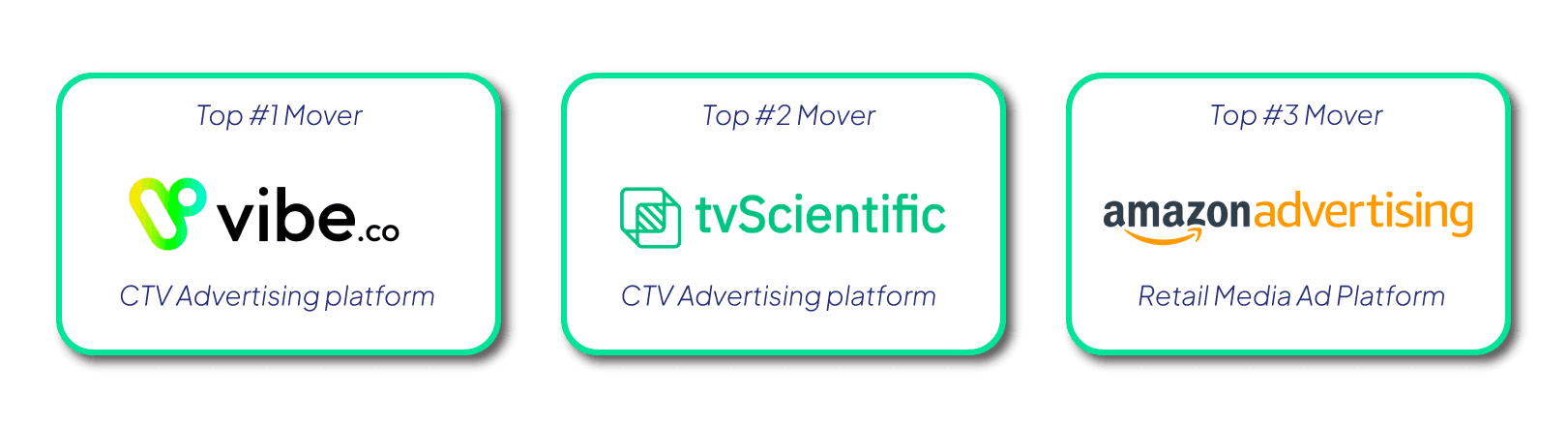

There are a few channels that moved exponentially more than all others, which did and did not surprise us. One of the most prominent trends during 2023 was the rise of CTV and OTT advertising, where many companies view this as a performance channel.

We have also seen another trend during 2023 with Retail Media , a new opportunity for Advertisers, reaching a captive and unique set of users.

The top 3 biggest movers (up) were:

We have also seen several platforms losing substantial share of spend across Gaming ad spend. The channels we saw drop the most are: Chartboost, BlueStacks, DataSeat

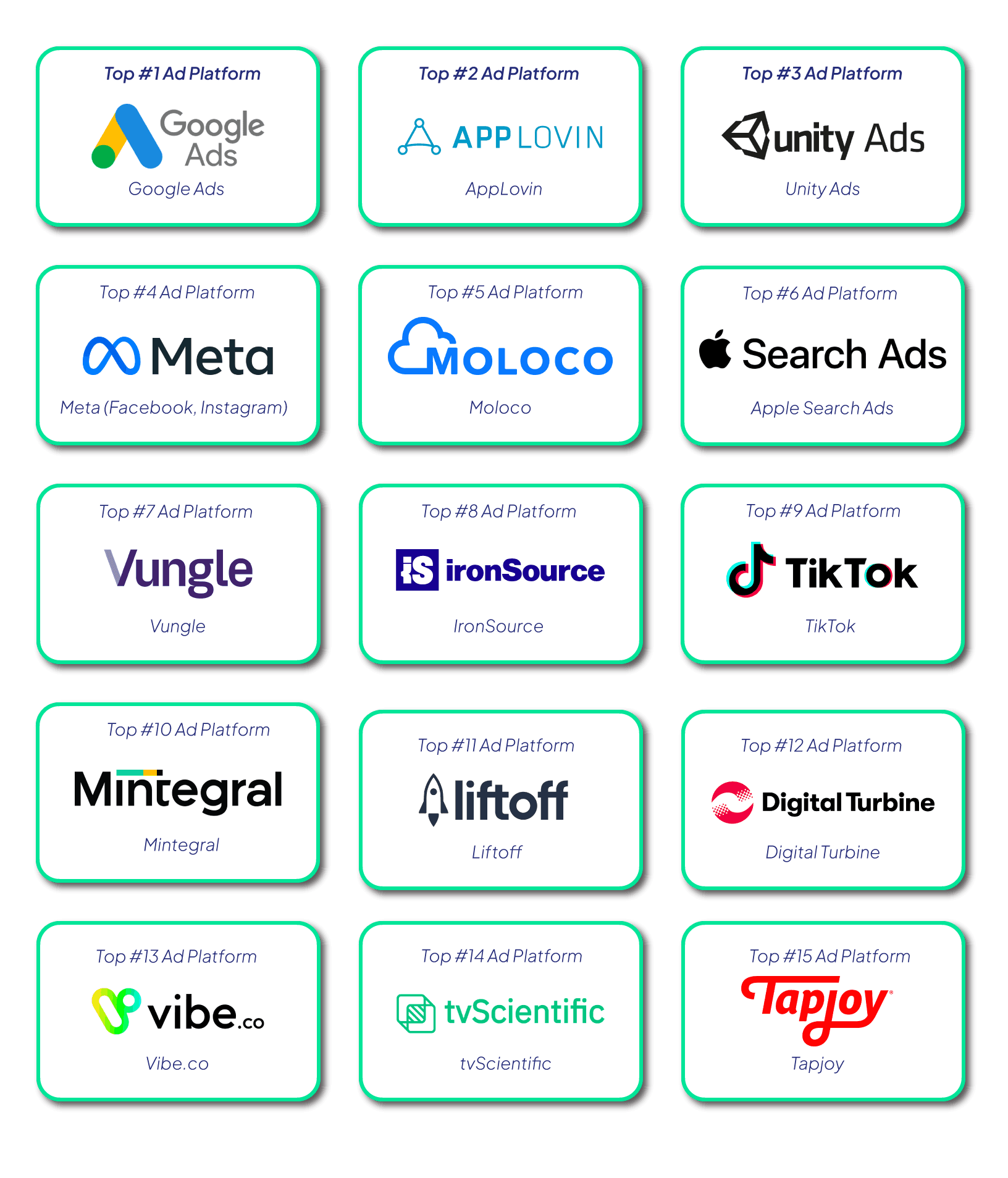

The following top 15 advertising channels took the biggest share of spend we’ve seen across mobile gaming companies. These represent 71% of the total ad spend we see across Gaming advertising budgets.

What we found most interesting was the rise of AppLovin. Following the Unity Runtime Fees announcement, we have seen Gaming companies shift budgets from Unity and IronSource towards AppLovin, however, the bigger trend working in AppLovin’s advantage is their access to 1st party user level data for targeting and segmentation, and the move to SKAD billing for iOS campaigns.

We have also seen the increase of Apple Search Ads. With more ad formats available, and a grip over targeting and attribution, ASA is playing a very important part as an advertising channel for gaming companies.

Mintegral seems to be a favorite amongst hyper casual gaming studios.

We cannot ignore some prominent up and comers, which we see more and more across many gaming advertisers. While some of these channels may have limited inventory, not allowing them to break into the top ad platform list, these are all providing inventories for gaming advertisers across the globe:

2024 will be an interesting year, with the coming changes to privacy. Gaming companies who are ready for the coming changes will continue scaling by utilizing the best performing advertising channels.

Maor is the CEO & Co-Founder at INCRMNTAL. With over 20 years of experience in the adtech and marketing technology space, Maor is well known as a thought leader in the areas of marketing measurement. Previously acting as Managing Director International at inneractive (acquired by Fyber), and as CEO at Applift (acquired by MGI/Verve Group)